A Story of Market Timing and Fortunes Made

Imagine sitting down with your uncle, a seasoned investor, as he recalls the early days of his investment journey. He tells you how he bought Bitcoin at $500, back when it was just a curiosity to most investors. He held onto his Bitcoin despite market ups and downs, and today, he’s reaping the rewards. Now, he’s once again eagerly watching Bitcoin, convinced by recent expert predictions that the next massive surge is around the corner. Like your uncle, investors and experts worldwide are sensing a significant shift in the market. But what’s fueling this potential wave, and what are the key factors behind these bold predictions?

Interior

Interior Exterior

Exterior Engine

Engine

Bitcoin has proven resilient, adaptable, and highly lucrative for long-term holders. But what lies ahead may be its biggest moment yet. Here’s why experts are forecasting a massive surge in Bitcoin’s value and how investors can prepare to ride the next wave.

Table of Contents

- The History of Bitcoin Surges: Lessons Learned

- Current Market Trends: Why Experts Are Bullish

- Factors Driving a Potential Bitcoin Surge

- Institutional Interest and Adoption

- Global Economic Factors and Inflation Hedge

- How to Prepare for the Next Bitcoin Wave

- Expert Opinions on Bitcoin’s Future

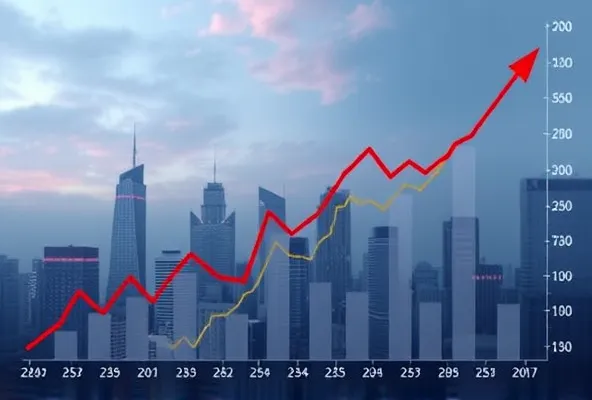

1. The History of Bitcoin Surges: Lessons Learned

Bitcoin’s Journey So Far

Since its inception in 2009, Bitcoin has experienced several notable surges, each driven by a unique set of factors. From the initial curiosity-driven price jumps to the historic bull runs of 2017 and 2020, Bitcoin’s price journey has been anything but linear. In 2017, Bitcoin reached nearly $20,000 before a major correction, only to rebound even stronger in 2020 when it crossed $60,000.

Patterns and Predictability

Although Bitcoin is known for its volatility, experts see patterns in its surges. Many surges follow a cycle tied to the Bitcoin “halving,” an event that reduces the rate at which new Bitcoin is created. Historically, these halvings, which occur roughly every four years, have set the stage for bull markets.

What Past Surges Teach Us

Each surge has taught the market valuable lessons: Bitcoin has a high potential for growth, but the market is also sensitive to regulatory news, institutional moves, and technological developments. Knowing these factors can help investors anticipate the next big move and understand the importance of timing.

2. Current Market Trends: Why Experts Are Bullish

Growing Institutional Involvement

In recent years, Bitcoin has gained acceptance not just from tech enthusiasts but from major institutions. Companies like Tesla, MicroStrategy, and Square have added Bitcoin to their balance sheets, seeing it as both a store of value and a growth asset. Even traditional financial institutions like JPMorgan and Goldman Sachs are developing Bitcoin-related services.

Publicly Traded Bitcoin Funds

The approval of Bitcoin ETFs (Exchange-Traded Funds) in countries like Canada and the U.S. futures-based Bitcoin ETF have made it easier for investors to add Bitcoin to their portfolios. These ETFs are encouraging broader acceptance, leading experts to believe more institutional capital will flow into the market, potentially fueling the next surge.

Halving Cycle Anticipation

The next Bitcoin halving is expected in 2024. Given that past halvings have preceded significant price increases, many analysts predict that this event will once again trigger increased demand, pushing prices higher.

3. Factors Driving a Potential Bitcoin Surge

Scarcity and Supply Limits

Bitcoin’s limited supply of 21 million coins makes it a unique asset. As demand grows, this scarcity model could lead to a “supply shock,” where the limited availability drives prices up. Experts suggest that the closer Bitcoin comes to its maximum supply, the higher its price may climb, especially as more investors look to add Bitcoin to their portfolios.

Decentralization and Security

Bitcoin’s decentralized nature makes it resistant to inflationary pressures and immune to government influence. With blockchain security, Bitcoin offers a transparent and secure system for transferring value, attributes that are increasingly attractive to investors wary of traditional financial systems.

Inflation and Economic Uncertainty

With rising inflation rates worldwide, many investors see Bitcoin as a hedge against devaluation. In times of economic uncertainty, digital assets like Bitcoin attract attention as they provide an alternative store of value that’s unaffected by traditional monetary policies.

4. Institutional Interest and Adoption

Bitcoin on Corporate Balance Sheets

Tesla, MicroStrategy, and other corporations have led the way in adding Bitcoin to their balance sheets, viewing it as an inflation hedge and growth asset. These companies’ moves have legitimized Bitcoin in the eyes of institutional investors, encouraging further adoption.

Financial Institutions Embracing Bitcoin

Major banks and asset managers now recognize Bitcoin’s potential. Companies like Fidelity, BlackRock, and Goldman Sachs have introduced Bitcoin products, allowing clients to gain exposure to digital assets within a traditional investment framework. This acceptance has bolstered confidence in Bitcoin’s long-term potential.

The Role of Bitcoin ETFs

Bitcoin ETFs allow investors to gain exposure to Bitcoin without directly purchasing the cryptocurrency. The introduction of futures-based Bitcoin ETFs in the U.S. and spot ETFs in other countries has opened up new channels for capital, signaling increased demand and pushing Bitcoin closer to mainstream adoption.

5. Global Economic Factors and Inflation Hedge

Inflationary Pressures Worldwide

With inflation rates climbing in many economies, the purchasing power of fiat currencies is declining. Bitcoin’s fixed supply and independence from central banks make it a promising hedge against inflation, drawing in investors who seek financial stability.

Currency Instability in Emerging Markets

Countries facing economic instability and currency devaluation, such as Argentina and Venezuela, have seen a rise in Bitcoin adoption. By storing value in Bitcoin, people in these regions protect themselves from local currency fluctuations, boosting Bitcoin’s global appeal as a financial safeguard.

Adoption as Legal Tender

El Salvador made headlines in 2021 by adopting Bitcoin as legal tender. This move demonstrates Bitcoin’s potential as a currency, not just a store of value, and could inspire other nations to explore similar paths. Countries with high inflation rates may turn to Bitcoin as an alternative currency, increasing demand and supporting long-term growth.

6. How to Prepare for the Next Bitcoin Wave

Investing with a Long-Term Perspective

Experts advise viewing Bitcoin as a long-term investment rather than a short-term speculative asset. By “HODLing”—holding onto Bitcoin through market volatility—investors can benefit from Bitcoin’s potential for growth over time, particularly during the anticipated surge.

Diversifying and Managing Risk

Bitcoin’s volatility means it should be part of a diversified portfolio. Investing in other digital assets, like Ethereum or stablecoins, can help balance risk. Additionally, considering only a small percentage of your portfolio for Bitcoin is a smart way to manage exposure.

Using Secure Storage Options

Given Bitcoin’s digital nature, secure storage is critical. Consider using hardware wallets like Ledger or Trezor to store Bitcoin offline, protecting it from cyber threats and securing your investment for the long term.

7. Expert Opinions on Bitcoin’s Future

Analyst Predictions on Bitcoin’s Price

Many analysts predict Bitcoin could reach new highs in the coming years. Some forecasts place Bitcoin’s future value between $100,000 to $500,000, driven by scarcity, institutional adoption, and economic instability. While these predictions are speculative, they demonstrate the optimism surrounding Bitcoin’s potential.

The Halving Effect and Future Market Cycles

Experts frequently point to Bitcoin’s halving cycles as a primary driver of market growth. The next halving, expected in 2024, could set the stage for another bull run, similar to those following previous halvings. Understanding this cycle is key to anticipating potential price increases.

Global Economic Impacts on Bitcoin

As inflation and currency devaluation continue to affect global markets, Bitcoin’s role as a decentralized asset becomes increasingly relevant. Economists suggest that Bitcoin’s future could see further integration into mainstream finance, offering a stable store of value amid economic uncertainty.

FAQ

Q1: What is causing experts to predict a Bitcoin surge?

Experts cite factors like institutional adoption, Bitcoin’s scarcity, inflation concerns, and upcoming halvings as reasons for the anticipated surge. Bitcoin’s unique qualities make it a strong candidate for long-term growth.

Q2: How does Bitcoin’s halving affect its price?

Bitcoin’s halving reduces the rate at which new Bitcoin is created, decreasing supply. Historically, this reduction has led to increased demand and price surges, as seen in previous halvings.

Q3: Should I buy Bitcoin now, or wait for a lower price?

Timing the market is challenging, especially with volatile assets like Bitcoin. Many experts suggest dollar-cost averaging, a strategy where you invest a fixed amount regularly, regardless of price.

Q4: Is Bitcoin safe as a long-term investment?

While Bitcoin has shown substantial growth, it’s also volatile and not without risk. Experts recommend viewing Bitcoin as part of a diversified portfolio and holding it long-term to offset short-term price fluctuations.

Q5: How much should I allocate to Bitcoin in my portfolio?

A common recommendation is to start with a small allocation, between 1-5% of your portfolio, depending on your risk tolerance and investment goals.

Conclusion: Anticipating Bitcoin’s Next Big Wave

Bitcoin’s journey from a niche digital asset to a global phenomenon has been remarkable. With institutional interest, economic instability, and technological advancements, experts are increasingly optimistic about Bitcoin’s future. As the market prepares for the next potential surge, investors have the chance to capitalize on what could be one of the most significant financial waves of our time. By staying informed, managing risks, and adopting a long-term perspective, you can position yourself to ride the wave and benefit from the opportunities Bitcoin may bring.